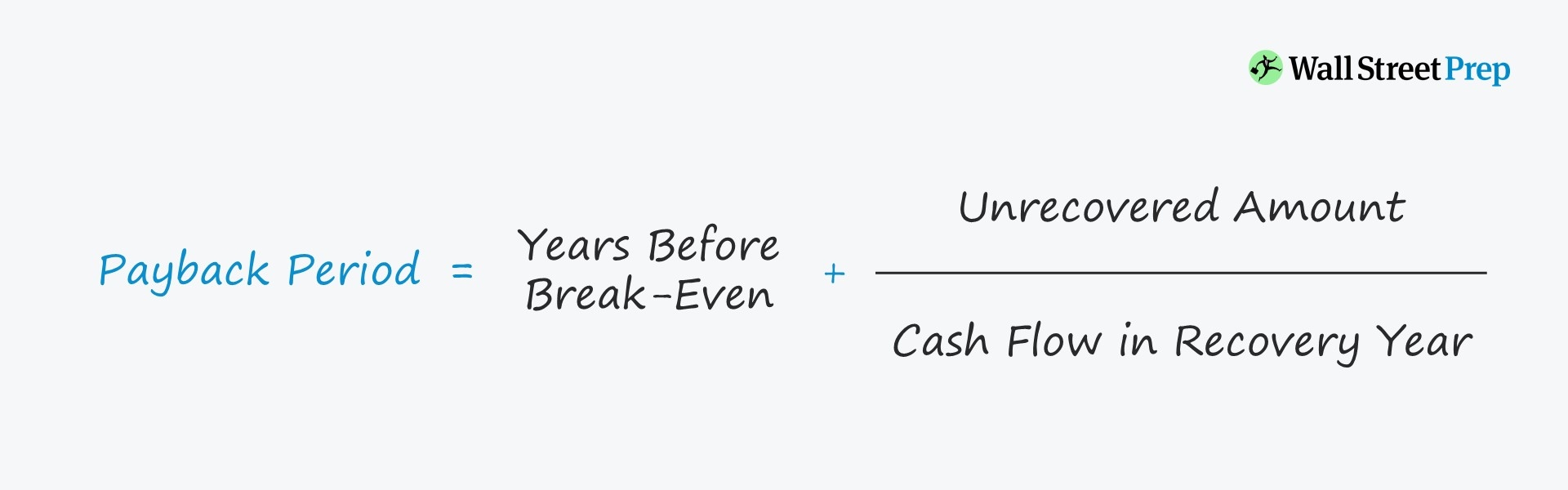

Simple payback period formula

Hence the total pay-back period will be. The simple payback period formula would be 5 years the initial investment divided by the cash flow each period.

What Is Payback Period Formula Calculation Example

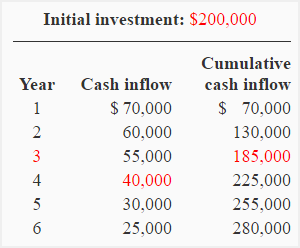

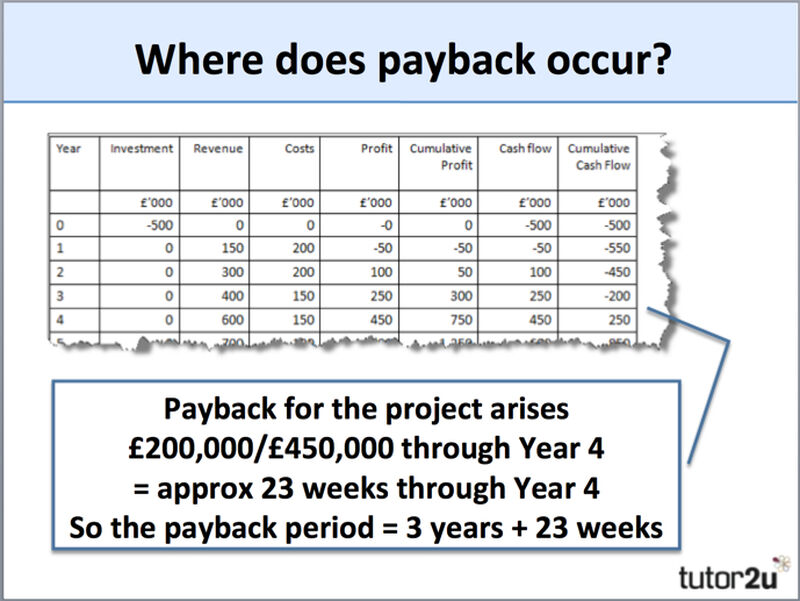

4 years 66200110000 46 Years Machine B is getting 549300 at the end of year 4 and only 30700 580000- 549300 has to get in year 5.

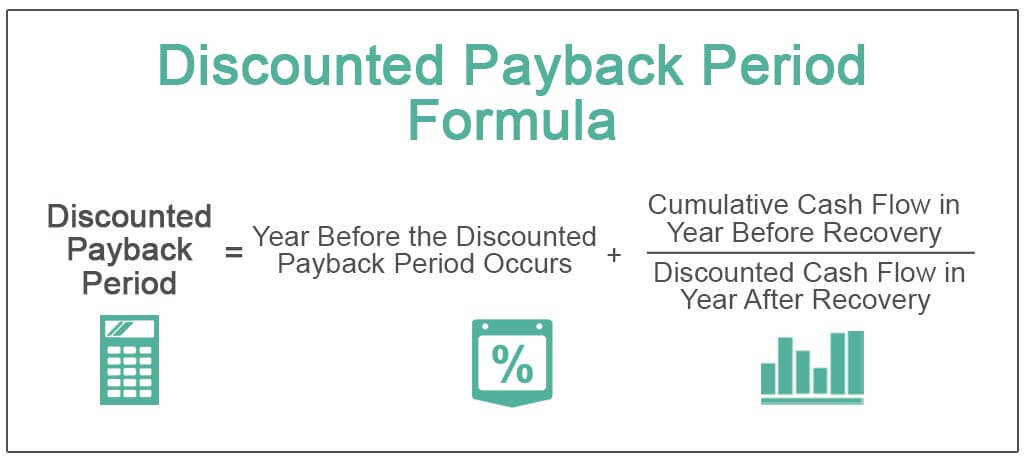

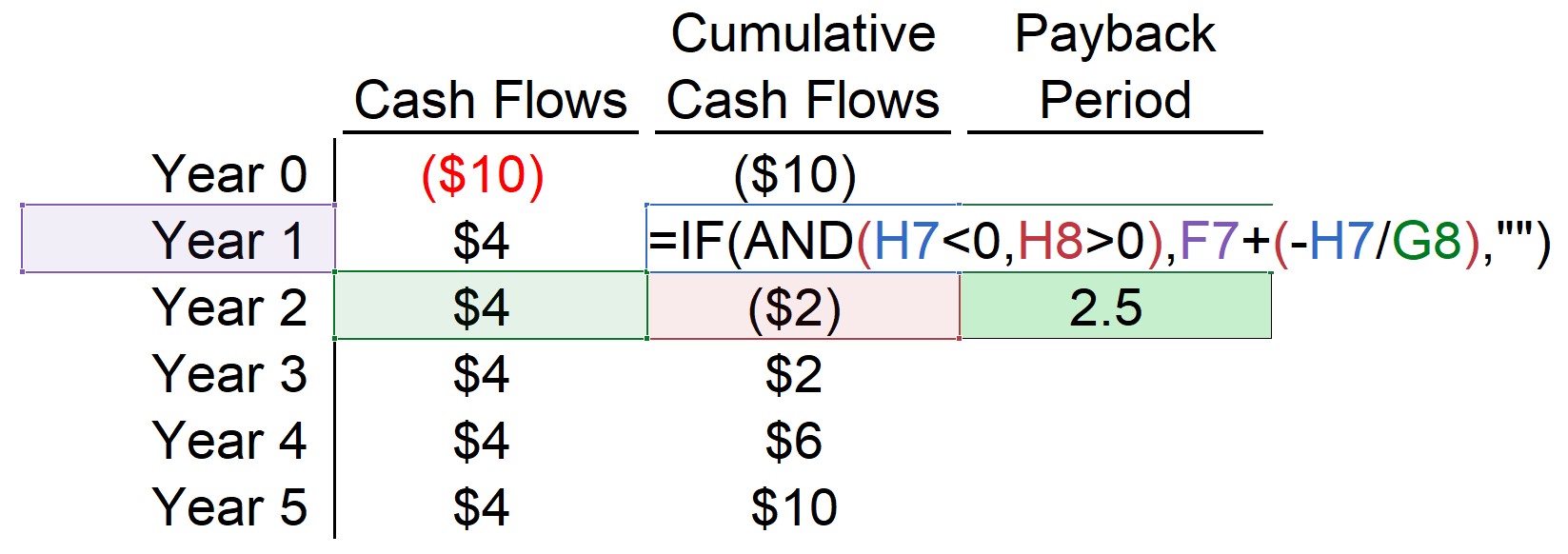

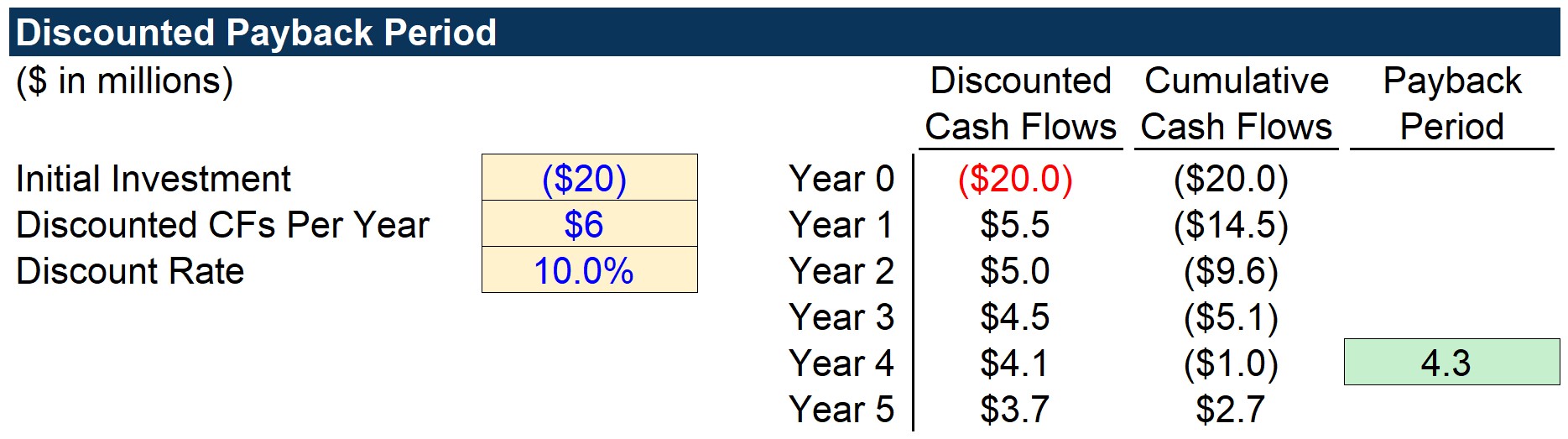

. However the discounted payback period would look at each of those. We will need the following number of months from the last period to break even. To calculate a more exact payback period.

Input Data in Excel. As you can see using this payback period calculator. You can use the.

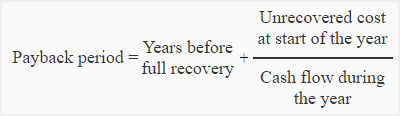

Calculate Net Cash Flow. The payback period calculation is simple. The simple payback period formula is calculated by dividing the cost of the project or investment by its annual cash inflows.

Find Cash Flow in Next Year. Payback period formula Written out as a formula the payback period calculation could also look like this. Payback Period Initial Investment Annual Payback For example imagine a.

68 ie the time taken to generate this amount will be 022 years 68308. Cumulative Cash flows for last period with negative number 3193. Payback Period p -.

Number of months. The payback period is expressed in years and fractions of years. For example if a company invests 300000 in a new production line and the production line then produces.

Payback Period Initial investment Cash flow per year As an example to calculate the payback period of a 100 investment with an annual payback of 20. The payback period is the total investment required to purchase the asset or fund the project divided by the net annual cash flow which is. 100 20 5 years.

Payback period initial investment annual payback Before making an investment its helpful to consider how long it may take to recover its cost. It can also be calculated using the formula. So payback here is.

Payback Period Amount to be InvestedEstimated Annual Net Cash Flow. Now the time taken to recover the balance amount of Rs. The payback formula is simple.

Investment Annual Net Cash Flow From Asset It can get a bit tricky when annual net cash flow is expected to vary from year to. Retrieve Last Negative Cash Flow.

Payback Period Method Commercestudyguide

Payback Method Formula Example Explanation Advantages Disadvantages Accounting For Management

Payback Period Summary And Forum 12manage

Discounted Payback Period Definition Formula Example Calculator Project Management Info

Undiscounted Payback Period Discounted Payback Period

Calculate The Payback Period With This Formula

Discounted Payback Period Meaning Formula How To Calculate

How To Calculate The Payback Period With Excel

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube

Payback Period Formula And Calculator Excel Template

Payback Period Formula And Calculator Excel Template

Payback Method Formula Example Explanation Advantages Disadvantages Accounting For Management

How To Calculate The Payback Period With Excel

Payback Period Method Double Entry Bookkeeping

How To Calculate The Payback Period With Excel

Payback Period Business Tutor2u

Payback Period Formula And Calculator Excel Template